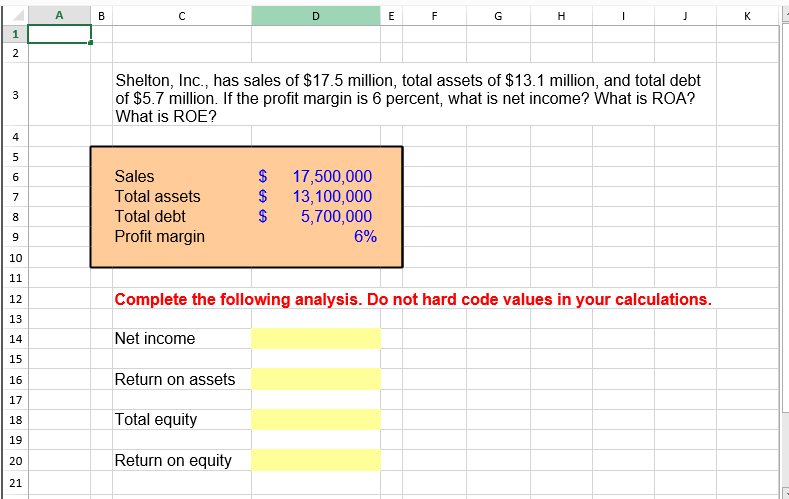

60+ pages shelton inc has sales of 17.5 million 1.6mb. What is the companys net income. Credit sales for the year just ended were 4207540. Solved Expert Answer to Shelton Inc has sales of 175 million total assets of 131 million and total debt of 57 million. Check also: reading and understand more manual guide in shelton inc has sales of 17.5 million What is the companys days sales in receivables.

Jul 11 2017. Answer to Shelton Inc has sales of 175 million total assets of 131 million and total debt of 57 million.

Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero

| Title: Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero |

| Format: eBook |

| Number of Pages: 200 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: November 2018 |

| File Size: 800kb |

| Read Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero |

|

Do not round intermediate calculations.

This question was answered on. If the profit margin is 6 percent w. Shelton Inc has sales of 175 million total assets of 131 million and total debt of 57 million. Shelton Inc has sales of 18 million total assets of 165 million and total debt of 94 million. Assume the profit margin is 9 percent. Assume the profit margin is 7 percent.

Assignment 2a Assignment 2 Fundamentals Of Corporate Finance Chapter 3 Chapter 3 Question 1 Sdj Inc Has Working Capital Of 1 920 Current Course Hero

| Title: Assignment 2a Assignment 2 Fundamentals Of Corporate Finance Chapter 3 Chapter 3 Question 1 Sdj Inc Has Working Capital Of 1 920 Current Course Hero |

| Format: PDF |

| Number of Pages: 291 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: December 2017 |

| File Size: 5mb |

| Read Assignment 2a Assignment 2 Fundamentals Of Corporate Finance Chapter 3 Chapter 3 Question 1 Sdj Inc Has Working Capital Of 1 920 Current Course Hero |

|

Solved Calculating Profitability Ratios 102 Shelton Inc Has Chegg

| Title: Solved Calculating Profitability Ratios 102 Shelton Inc Has Chegg |

| Format: ePub Book |

| Number of Pages: 235 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: April 2021 |

| File Size: 3mb |

| Read Solved Calculating Profitability Ratios 102 Shelton Inc Has Chegg |

|

Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero

| Title: Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero |

| Format: ePub Book |

| Number of Pages: 154 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: July 2020 |

| File Size: 1.6mb |

| Read Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero |

|

Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero

| Title: Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero |

| Format: eBook |

| Number of Pages: 249 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: July 2018 |

| File Size: 810kb |

| Read Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero |

|

Oneclass Wakers Inc Has Sales Of 29 Million Total Assets Of 17 5 Million And Total Debt Of 6

| Title: Oneclass Wakers Inc Has Sales Of 29 Million Total Assets Of 17 5 Million And Total Debt Of 6 |

| Format: eBook |

| Number of Pages: 294 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: December 2017 |

| File Size: 6mb |

| Read Oneclass Wakers Inc Has Sales Of 29 Million Total Assets Of 17 5 Million And Total Debt Of 6 |

|

Assignment 2a Assignment 2 Fundamentals Of Corporate Finance Chapter 3 Chapter 3 Question 1 Sdj Inc Has Working Capital Of 1 920 Current Course Hero

| Title: Assignment 2a Assignment 2 Fundamentals Of Corporate Finance Chapter 3 Chapter 3 Question 1 Sdj Inc Has Working Capital Of 1 920 Current Course Hero |

| Format: ePub Book |

| Number of Pages: 169 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: October 2019 |

| File Size: 1.5mb |

| Read Assignment 2a Assignment 2 Fundamentals Of Corporate Finance Chapter 3 Chapter 3 Question 1 Sdj Inc Has Working Capital Of 1 920 Current Course Hero |

|

Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero

| Title: Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero |

| Format: ePub Book |

| Number of Pages: 202 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: April 2018 |

| File Size: 2.1mb |

| Read Chapter 3 Solutions Chapter 3 Working With Financial Statements Solutions Basic 2 Calculating Profitability Ratios Lo2 Shelton Inc Has Sales Of 17 5 Course Hero |

|

Assignment 2a Assignment 2 Fundamentals Of Corporate Finance Chapter 3 Chapter 3 Question 1 Sdj Inc Has Working Capital Of 1 920 Current Course Hero

| Title: Assignment 2a Assignment 2 Fundamentals Of Corporate Finance Chapter 3 Chapter 3 Question 1 Sdj Inc Has Working Capital Of 1 920 Current Course Hero |

| Format: ePub Book |

| Number of Pages: 293 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: July 2017 |

| File Size: 2.6mb |

| Read Assignment 2a Assignment 2 Fundamentals Of Corporate Finance Chapter 3 Chapter 3 Question 1 Sdj Inc Has Working Capital Of 1 920 Current Course Hero |

|

A B C D F G H I J K L Shelton Inc Has Sales Of Chegg

| Title: A B C D F G H I J K L Shelton Inc Has Sales Of Chegg |

| Format: ePub Book |

| Number of Pages: 266 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: December 2018 |

| File Size: 1.5mb |

| Read A B C D F G H I J K L Shelton Inc Has Sales Of Chegg |

|

Solved Calculating Profitability Ratios 102 Shelton Inc Has Chegg

| Title: Solved Calculating Profitability Ratios 102 Shelton Inc Has Chegg |

| Format: ePub Book |

| Number of Pages: 282 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: November 2021 |

| File Size: 2.3mb |

| Read Solved Calculating Profitability Ratios 102 Shelton Inc Has Chegg |

|

Working With Financial Statements

| Title: Working With Financial Statements |

| Format: PDF |

| Number of Pages: 278 pages Shelton Inc Has Sales Of 17.5 Million |

| Publication Date: February 2018 |

| File Size: 1.7mb |

| Read Working With Financial Statements |

|

Shelton Inc has sales of 18 million total assets of 165 million and total debt of 94 million. Do not round intermediate calculations. Shelton Inc has sales of 18 million total assets of 165 million and total debt of 94 million.

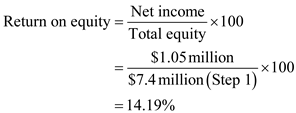

Here is all you need to know about shelton inc has sales of 17.5 million If the profit margin is 6 percent what is net income. Shelton inc has sales of 175 million Shelton Inc has sales of 175 million total assets of 131 million and total debt ofShelton Inc has sales of 175 million total assets of. Shelton Inc has sales of 18 million total assets of 165 million and total debt of 94 million. Chapter 3 solutions chapter 3 working with financial statements solutions basic 2 calculating profitability ratios lo2 shelton inc has sales of 17 5 course hero solved calculating profitability ratios 102 shelton inc has chegg oneclass wakers inc has sales of 29 million total assets of 17 5 million and total debt of 6 chapter 3 solutions chapter 3 working with financial statements solutions basic 2 calculating profitability ratios lo2 shelton inc has sales of 17 5 course hero assignment 2a assignment 2 fundamentals of corporate finance chapter 3 chapter 3 question 1 sdj inc has working capital of 1 920 current course hero working with financial statements What is the receivables turnover.